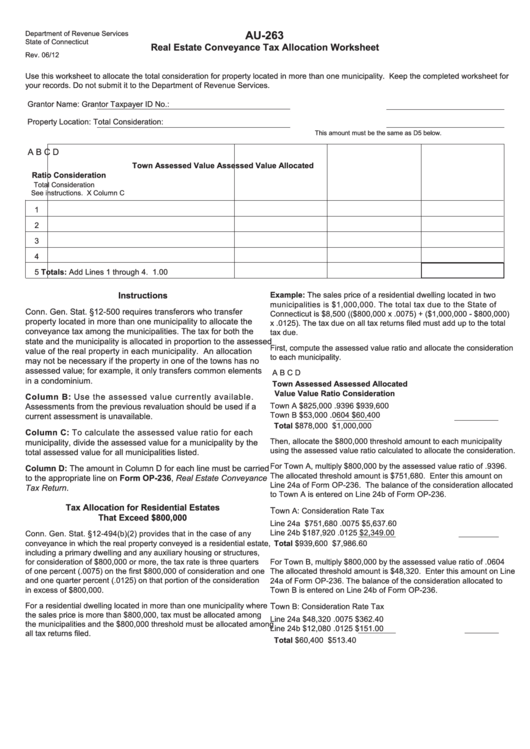

J: The Pennsylvania Department of Revenue, Pennsylvania Inheritance and Realty Transfer Tax, Bureau of Individual Taxes, released the 2021 Common Level Ratio Real Estate Valuation Factors for documents dated from Jto June 30, 2023. Montgomery County Common Level Ratio (CLR) Real Estate Valuation Factors - This lists past and present common level ratio factors from July 2, 1986, to the presentįor more information, including forms, common level ratio indices and exemptions contact the Pennsylvania Department of Revenue.įor information regarding Realty Transfer Tax Payments and Refund Procedures, please refer to the Pennsylvania Department of Revenue website. Deeds, mortgages, powers of attorney, and other instruments relating to or affecting the title to real estate in this state, shall be recorded in the county in. Must include 2 separate Statements of Value 2 separate Real Estate Transfer Tax checks for the State 2 separate Real Estate Transfer Tax checks for the. Access the form: REV-183 EXĪll Pennsylvania Counties Common Level Ratio (CLR) Real Estate Valuation Factors - This lists the current common level ratio factors as of July 1, 2023. There is a Transfer Tax of 2 (1 to the state and 1 to the municipality and school district) for all property sales in Pennsylvania on the value of the. To record with an exemption, use a Realty Statement of Value Transfer Tax Form (REV-183) from the Pennsylvania Department of Revenue. What do I do if I paid my mortgage off but theres no record of it Is it possible to keep a property transfer from appearing in the newspaper Do I need a copy.

#Conveyance in real estate pa registration

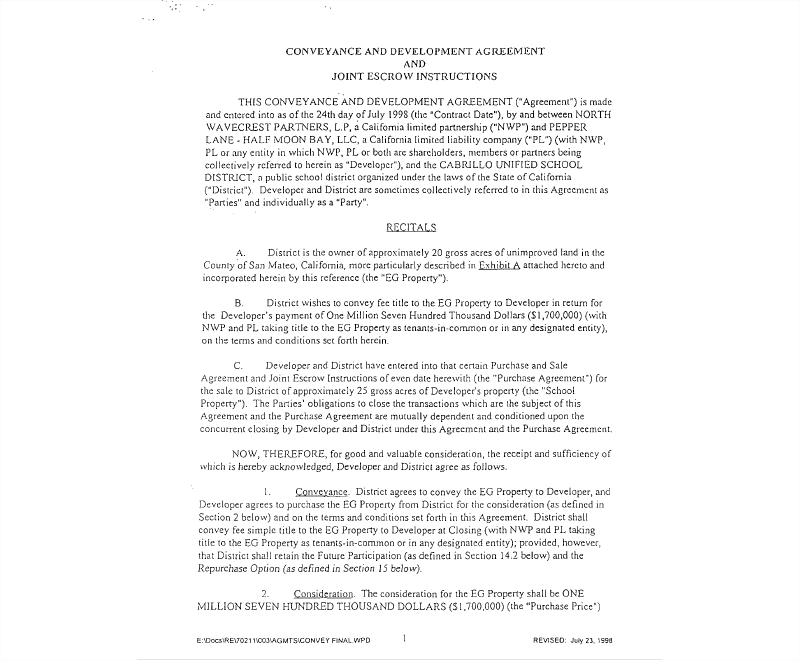

The Montgomery County Recorder of Deeds is responsible for the collection and distribution of real estate transfer taxes. Property Registration - Chester Realty Transfer Tax - 2023 Common Level Ratio Real Estate Valuation Factors REV-183. Then, we will explain the requirements for conveyance by spouses for real estate, according to Minnesota Statutes 500.19 and 507.02.

0 kommentar(er)

0 kommentar(er)